Numerous apps claim in order to offer you instant cash advances, plus many of which we’ve examined reside up to become capable to of which claim. We’ve recently been able in purchase to get cash within our bank accounts much less compared to ten minutes right after downloading the app! Of course, in nearly each case you’ll pay additional with respect to of which conveniences, with express charges that will could add pretty a little bit in purchase to the particular cost of borrowing several bucks.

Methodology: Just How All Of Us Selected These Kinds Of Providers

Likewise, it can be appealing to count on typically the software in order to accessibility your gained funds earlier, which may come to be a poor behavior in case you’re not careful. Varo will be borrow cash app a economic institution that gives money advances regarding up to become able to $500 in order to its customers. Typically The greatest portion will be of which these people don’t demand ideas or attention obligations. As An Alternative, you pay a flat payment dependent on the particular advance sum, plus you pay back it upon your following payday. When a person may’t pay a payday loan, an individual may get away another in order to repay the particular very first. When a person could’t pay off that will, an individual can borrow again or renew, generally paying a revival fee every period.

Happy Cash Personal Loan Overview: Low-fee Credit Score Card Personal Debt Consolidation

Any Time it comes in purchase to picking a money advance software, there usually are several choices in purchase to pick through. The financial loan amounts are relatively tiny, and the particular repayment windows is usually limited to thirty five days and nights. Furthermore, the optional suggestions plus donations may include to become capable to typically the expense associated with the particular financial loan in case an individual select to be in a position to include them. Quick funding obtainable with Turbo Charges or twenty-four to forty-eight hours regarding MoneyLion examining bank account users; a couple of to be in a position to five company days with consider to nonmembers.

It’s not really a great concept in order to obtain in the particular routine of making use of funds advance programs, but occasionally it’s essential. Prior To selecting this alternative with consider to your own financing needs, find out typically the pros and cons associated with funds advance apps. The Particular software promises earlier paychecks, zero concealed costs, and debit card advantages, among additional functions. A Person furthermore obtain price safety, where you’ll obtain a reimbursement associated with upwards to end upward being in a position to $250 in case an individual find a lower cost regarding anything a person bought within just ninety days with your current MoneyLion Charge Mastercard®. You could get your own funds advance the particular same day time applying the express option. On The Other Hand, guarantee that typically the charge is usually lower compared to any penalties received regarding any kind of late repayments for which usually you’re borrowing typically the money.

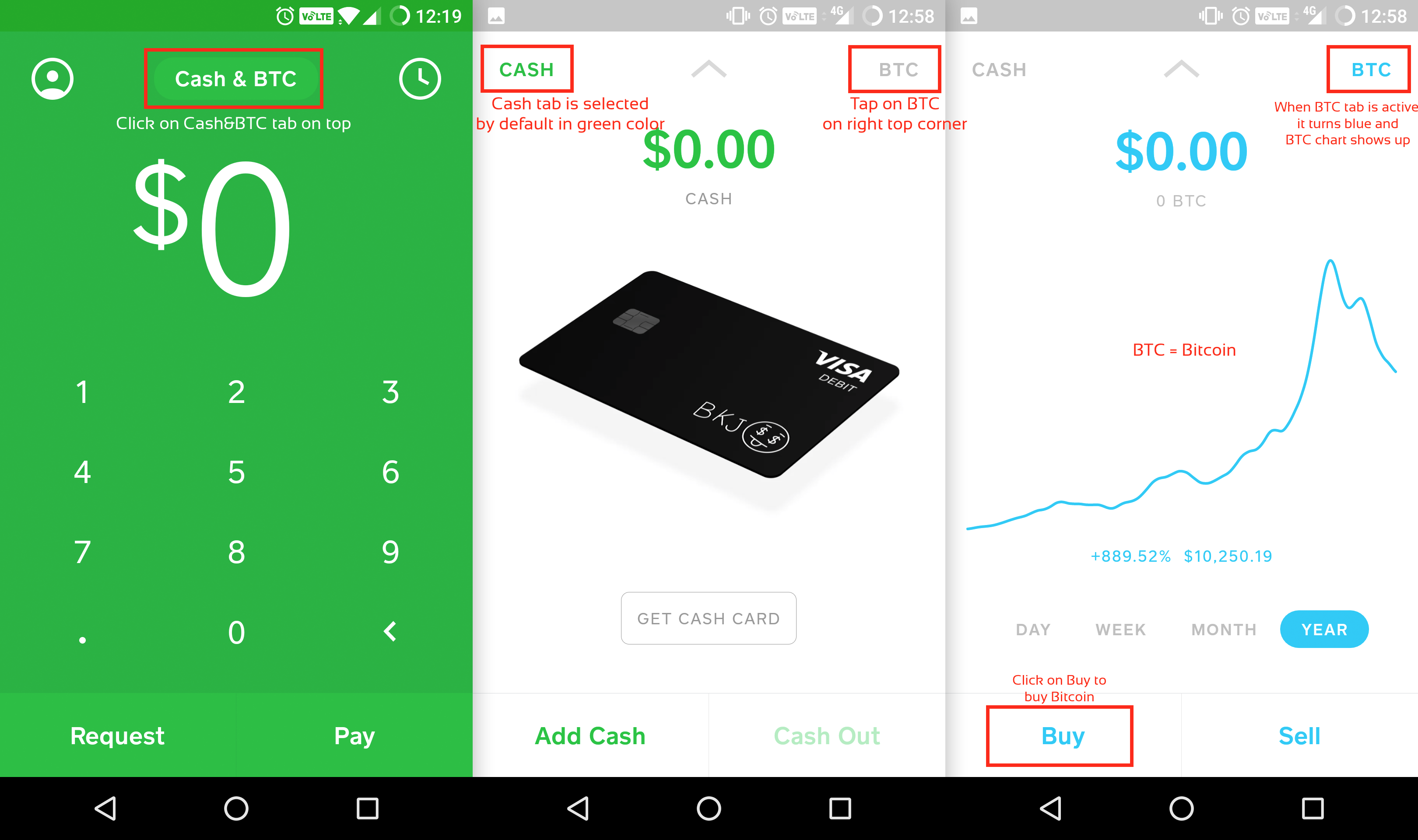

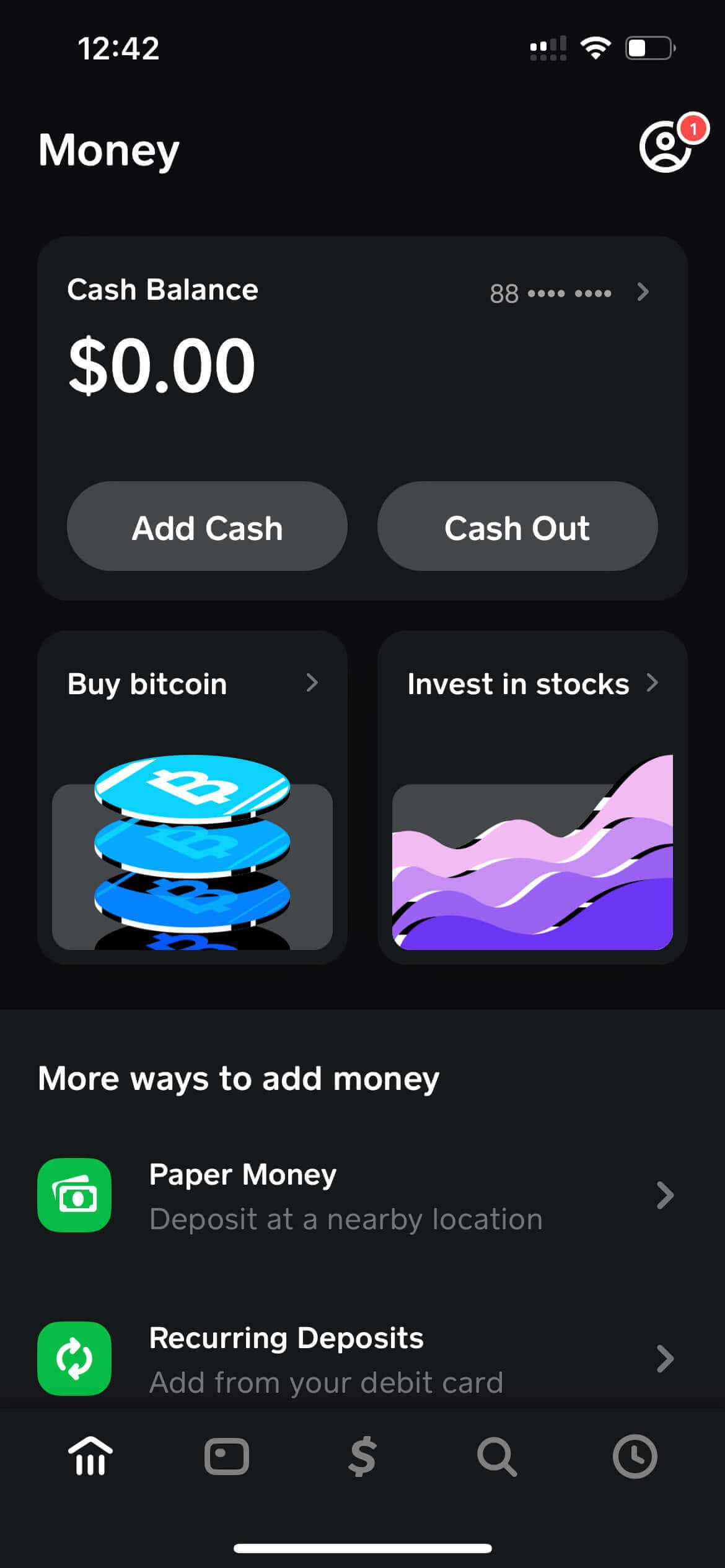

MoneyLion includes a membership company model with regard to its “InstaCash” alternative, which usually gives a fee-free advance associated with upwards to end upwards being capable to $250 right up until payday. Cash advance apps must end upward being conscious regarding your own pay period of time and salary sum. When a person would like in buy to entry your direct deposit together with Cash Application and wish to hook up your Funds App account to be capable to Money Advance applications, it may possibly change out there unsuccessful. A Few Money Application accounts cases may borrow cash directly from Funds App through the Cash Application Borrow function.

It could help an individual include unpredicted expenses plus stay afloat right up until payday. A Single associated with the major functions associated with Cleo is usually that will it can offer you upward in purchase to $250 like a money advance, along with no credit rating examine or interest charges. However, if this is usually your current first time making use of this feature, the cap is arranged at $100. 1 regarding the particular rewards regarding using Varo is of which funds advancements regarding $20 or fewer have zero costs.

Inside this particular weblog post, we will explore some of the particular greatest cash advance applications of which function with Money Application. When your own boss companions along with Payactiv, that’s your greatest bet for low-fee accessibility in order to your earned wages. In Case you could employ the some other tools offered with typically the Enable app, typically the registration charge might be worth it regarding you. The exact same will go with consider to Dave—we particularly just like the particular in-app aspect hustle opportunities.

- Repayment is usually programmed, yet Sawzag will never ever overdraft a customer’s bank account, so a person don’t have in order to worry concerning any added costs from your own lender.

- It’s not really a good thought in order to acquire within typically the behavior regarding making use of money advance applications, but at times it’s necessary.

- These People may possibly have got money assistance or foods stamps in buy to help households within need.

- These payday advance applications primarily acknowledge standard financial institutions because these people could authenticate transactions along with Plaid plus verify your current history of a stable salary.

- All Of Us recommend EarnIn as the particular leading app considering that it offers the particular greatest advance limit in add-on to no required charge.

- This Particular application goes past lending by simply offering options regarding investment and cryptocurrency buying and selling.

Apps Just Like Dave For Little Money Advances Inside 2025

We have got a checklist of 9 cash advance programs of which some regarding you may previously know. These People help to make it simple to end upwards being able to borrow funds with regard to a short while with out difficulty. A Person don’t require a Funds Application bank account, yet possessing each could end upward being beneficial.

Many money advance programs have made it simpler compared to actually to become able to borrow small sums whilst adding efficiently along with your current Money Software accounts. Money advance apps offer a person entry to become in a position to funds prior to your own payday, giving a a great deal more affordable alternative in order to standard financial institution overdraft services, which usually usually appear with high fees. Rather regarding counting about high-interest loans, these kinds of applications use voluntary ideas or flat costs as a earnings resource. Several private mortgage providers possess a fast approval procedure and could have funds in order to an individual inside just several business times or actually the same company day time in case a person are eligible. Just Before borrowing, end up being aware regarding the particular loan APR and virtually any origination or additional costs.