Now the key is to start laying groundwork you can build on as part of your management of internal risks. Once you know where to look, you can more easily identify what steps to take. Risks that aren’t unheard of – but can also be managed with good processes and regular review. These risks often start out small and become larger issues over time, like a weed growing in your garden.

Being proactive in identifying and managing them not only prevents potential damage but also fortifies your operation against external uncertainties. This leads to lower costs, greater likelihood of successful project outcomes, and increased customer satisfaction. Continuously assessing your level of risk and scoring both internal and external risks allows your organization to plan responses appropriately should one pass the threshold of your risk appetite. Internal risks must be managed, both because they’re usually a significant source of risk and because they’re more controllable. The best way to prepare for internal risks is by making sure that your overall risk management plan includes them fifo vs lifo: what is the difference as well as external ones. Remember, situational risks may come from outside, but their impact reverberates internally.

What Is the Difference Between Inherent Risk and Control Risk?

These risks can be forecasted with some reliability, and therefore, a company has a good chance of reducing internal business risk. Detection risk occurs when auditors simply fail to detect an easy-to-notice error. Detection risk may occur unintentionally in that an auditor may miss an error accidentally. In other cases, an auditor may misinterpret the figures on the financial statements they’re charged with reviewing that it results in one or more errors.

Tie Risk To Financial Impact with Risk Quantification

High-performing employees and departments, working together, enhance the company’s ability to adapt to market changes and boost productivity. By identifying and optimizing these internal factors, businesses can enhance their capabilities, creating a strong internal environment that promotes sustainability and resilience. For example, a technological risk that a business may face includes outdated operating systems that decrease production ability or disruptions in supplies or inventory. Also, a technological risk could include not investing in an IT staff to support the company systems. Server and software problems that lead to equipment downtime can increase the risk of production shortfalls and financial costs due to less revenue and idle workers.

Credit insurance is usually very comprehensive and provides protection against debt default for a wide range of reasons, covering virtually every conceivable commercial or political reason for non-payment. You can further reduce opportunity and make reporting even easier by setting up a fraud hotline. In many cases of fraud, others were aware that something suspicious was going on, but they didn’t want to get involved. Not seeing risks doesn’t mean there are none – the grateful dead attend their first acid test on this day in 1965 it means you’re missing something.

SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) is a key tool in strategic planning that helps businesses evaluate internal and external factors. Internal factors, such as company culture, leadership, and financial resources, can be classified as either strengths or weaknesses depending on how they influence the business. In this article, Robert S. Kaplan and Anette Mikes present a categorization of risk that allows executives to understand the qualitative distinctions between the types of risks that organizations face. Preventable risks, arising from within the organization, are controllable and ought to be eliminated or avoided. Examples are the risks from employees’ and managers’ unauthorized, unethical, or inappropriate actions and the risks from breakdowns in routine operational processes.

What Is Inherent Risk?

Improving personnel management can help reduce internal risks by boosting employee morale through effective compensation and empowerment. Business risk is the exposure a company faces that could eventually lead to lower what is the matching principle in accounting revenue, profits, and financial losses. Companies face business risks every day, and those risks are part of operating in the segment or industry in which the company resides.

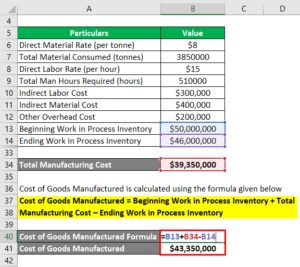

You can proactively predict, manage, and mitigate risk with true financial context. The risk score is the result of your analysis, calculated by multiplying the Risk Impact Rating by Risk Probability. It’s the quantifiable number that allows key personnel to quickly and confidently make decisions regarding risks. Risk identification should not only be performed at the earliest stages of project development, it should also be reassessed throughout the project life cycle. The three types of internal risk factors are human factors, technological factors, and physical factors. These risks are important to take into account as they can drastically mislead investors and are generally best combatted by getting several qualified auditors to go over the books.

- Not seeing risks doesn’t mean there are none – it means you’re missing something.

- Also, having access to the credit markets and establishing financing in the form of loans, credit lines, or bonds before the risks materialize can help companies stay financially solvent during tough times.

- Also, business credit lines issued by banks, are used by companies to tap into for working capital.

- Risks that aren’t unheard of – but can also be managed with good processes and regular review.

- If all your metrics are going green, it’s easy to ignore that one red flag waving in the wind.

Complex financial transactions, such as those during the lead-up to the financial crisis, can be difficult for even the most intelligent financial professionals to understand. Asset-backed securities, such as collateralized debt obligations (CDOs), became difficult to account for as tranches of varying qualities were repackaged again and again. This complexity may make it difficult for an auditor to make the correct opinion, which in turn can lead investors to consider a company to be more financially stable than in actuality.

This step explores the risk’s potential qualitative and quantitative impacts — which will help in creating processes to mitigate negative consequences. In other words, risk analysis is about calculating probability and likely outcomes. When calibrated effectively, risk scores can help you identify and respond to risks in an appropriate fashion. Ultimately, they help support your company’s growth, reduce inefficiencies, and prevent reputational damage.